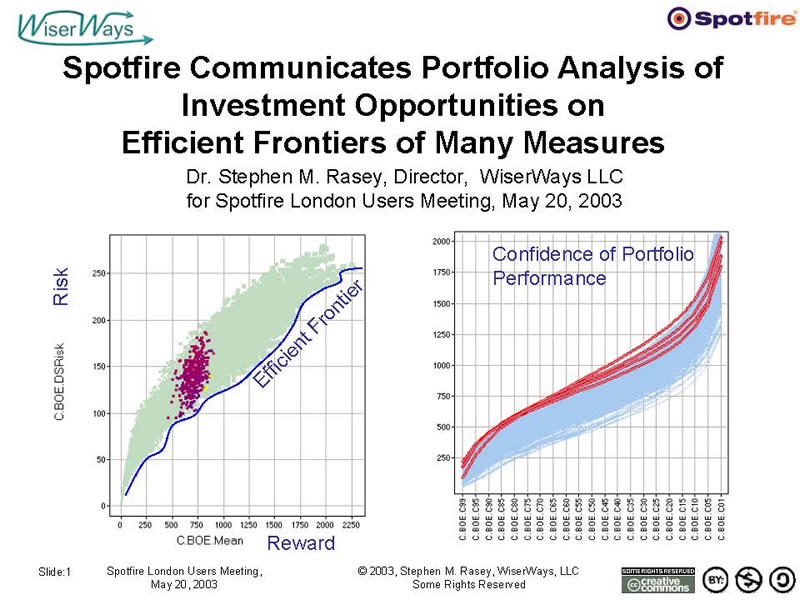

Spotfire Communicates Portfolio Analysis of Investment Opportunities on Efficient Frontiers of Many Measures

This London Spotfire conference presentation is also available in pdf format

Definitions

- Portfolio

- A collection of investments all owned by the same individual or organization .

- Efficient Portfolio

- A portfolio that provides the greatest expected return for a given level of risk , or equivalently, the lowest risk for a given expected return . also called optimal portfolio.

- Efficient Frontier

- The line on a risk-reward graph comprised of all efficient portfolios .

(Source: http://www.investorwords.com)

Portfolio Analysis

A search for Efficient candidate Portfolios from a collection of potential Investment Opportunities.

Acceptable Candidate Portfolios must satisfy Investors Requirements:

Operational – Physically doable

(rig avail, lead time, partners, Working Interest availability)

Political – (BU Capex avail, Maximum $ exposure)

Resource – Budget, People

Performance – Resources found, Production & Earnings Goals, Minimum acceptable results.

Investment Opportunities

Projects where you have an opportunity to invest capital with estimated, but uncertain, profitable returns in the future.

Example here: Exploration Projects

Types of Projects available to fund in this example

Data Base Schema (Projects)

Use the Access Database to prepare Queries for Spotfire

Use the Access Database to prepare Queries for Spotfire

F1D2 – Choose Canned Queries to send to Spotfire

View the Project Metrics and Flows.

S1D1 Query: Project Scalers with Flow Data oriented with Line Items in Columns, Years in rows.

ROR vs NPV color :Env Size:Prob

NPV vs MMBOE

If Success Cash Flow After Tax by year

MMBOE vs ProbGeo

Building a Candidate Portfolio

WiserWays MultiField Confidence Curve Calculator

The version used here can handle

a 200 Project inventory,

Up to 50 funded at any one portfolio

Up to 3 discrete working interest per project

Customized weighted project selection based upon good heuristics.

Each trace calculates has up to 50 Portfolio points.

Each Portfolio point has two confidence curves at isotiles (every 5%) for MMBOE and NPV written to the database.

Process time: 4 seconds per trace including writing to the Database. -- 10 Portfolios per second. (2.4Ghz Pentium IV)

Confidence Curves calculated directly without simulation

Available for sale from WiserWays.

View the Portfolio Confidence Curves and Project Funding.

T1D5 Query: Confidence Curves (MMBOE, NPV) and Funding level Each Project ( Wk.Int.) by Trace Sequence Number

MMBOE Risk Reward (Scatter Plot) Trace 602

NPV Risk Reward (Scatter Plot), Trace 602

NPV Risk Reward, Trace 602, with Details of Project WI

NPV Prob by Cumul Capex Trace 602

MMBOE Prob by Cumul Capex

NPV Risk Reward -Trace 616

MMBOE Confidence Curve - Profile Chart - Trace 616

NPV Confidence Curve - Profile Chart - Trace 616

Heat Map Trace 616

You can use any measure of risk

Efficient Frontiers can also

compare trade-offs between conflicting goals

4 Panel View: 400 MM Capex

DS NPV - Color by WI of 1 Project (386)

DS NPV - Color by WI of 1 Project (386)

Heat Map

View the Portfolio Confidence Curves and Portfolio Flow Data (Production, Devel Capex, CFAT, NIAT, CapEmpl) on a Risked Basis

T1F6 Query: Confidence Curves (MMBOE, NPV) and Portfolio Flow data (Years 2003 through 2012)

Case Study: Select Portfolios using

Capex, Cash Flow, Return on Capital Employed (ROCE), and Efficient Frontier constraints.

Looking at the Cash Flow Profiles, we decide $750 MM in negative Cash Flow is the most we can stand in any year.

We choose the ¼ closest to the efficient frontier of the NPV – Downside Risk plot.

Most of those selected are on the efficient frontier of the Reserves DS Risk Plot.

Next we inspect the NPV Confidence Curves.

Now we inspect ROCE for year 2007 against NPV.

Looking at ROCE by year, we see that for efficient frontier NPV portfolios, we have to give up the highest ROCE in 2005, 2006

Whittle away the worst ROCE’s for each year

Now down to 24 marked portfolos (Set r05)

We now ask, what if we need 2006 ROCE > 10%, what do we give up?

Of the ten portfolios left,

there are 6 different “traces” or Portfolio Builds.

Use the Spotfire Heat Map to determine

which Projects are funded in some or most Portfolios

and see which Projects are never funded.

The Projects, and how many times selected in the marked portfolios and at what average working interest.

WiserWays-Spotfire Portfolio Analysis Process

Define the population of potential Projects to fund

Define a set of Strategies for funding candidate portfolios.

Use an automated process to generate thousands of candidate portfoilos according to the different strategies.

Load the candidate Portfolios into Spotfire

Apply/change constraints by sliding Spotfire query devices.

Select many good portfolios that are close to the Efficient Frontiers of many different measures.

Find the projects most often funded in these good portfolios.

If happy with plan, Fund these projects, Execute Plan

Change and Negotiate Goals.

Refine Strategies.

Comparison of Analysis Methods

Spotfire Sheds Light on a Complicated Problem

- Woolsey’s 1 st Law

- “A Manager would rather live with a problem he cannot solve than accept a solution he does not understand.”

- Woolsey’s 2 nd Law

- “A Manager does not want, and will not pay for, an OPTIMUM solution. He wants to be better off now, as quickly and as cheaply as possible.

WiserWays Portfolio Calculator and Analyzer

By making VISIBLE the potential funding opportunities,

DECISION MAKERS can see available alternatives and the degree of difference (or equivalence) between them.

You can change your constraints in the conference room for real-time turnaround.

Understandable.

Quick. Easy. Inexpensive.

Thanks to

Spotfire

For the opportunity to speak here and for the work we have done together since 2001.

David Bailey, Spotfire

Joe Taylor, Spotfire (Houston)

For helping me debug the Access-Spotfire interaction.

Dr. Ian Learch (Prof. U. of S. Carolina)

Who in 1997 triggered my insight in how to develop the WiserWays Multifield Confidence Curve Portfolio Calculator.

And Thank You for your attention.